May 10, 2023

Relationship between tax rates and revenue collection

The relationship between tax rates and tax revenues is a complex and controversial topic in economics. Some economists argue that lowering tax rates can stimulate economic growth and increase tax revenues, while others contend that raising tax rates can reduce tax evasion and enhance social welfare. In this blog post, we will explore some of the theoretical and empirical evidence on this issue, and discuss some of the policy implications.

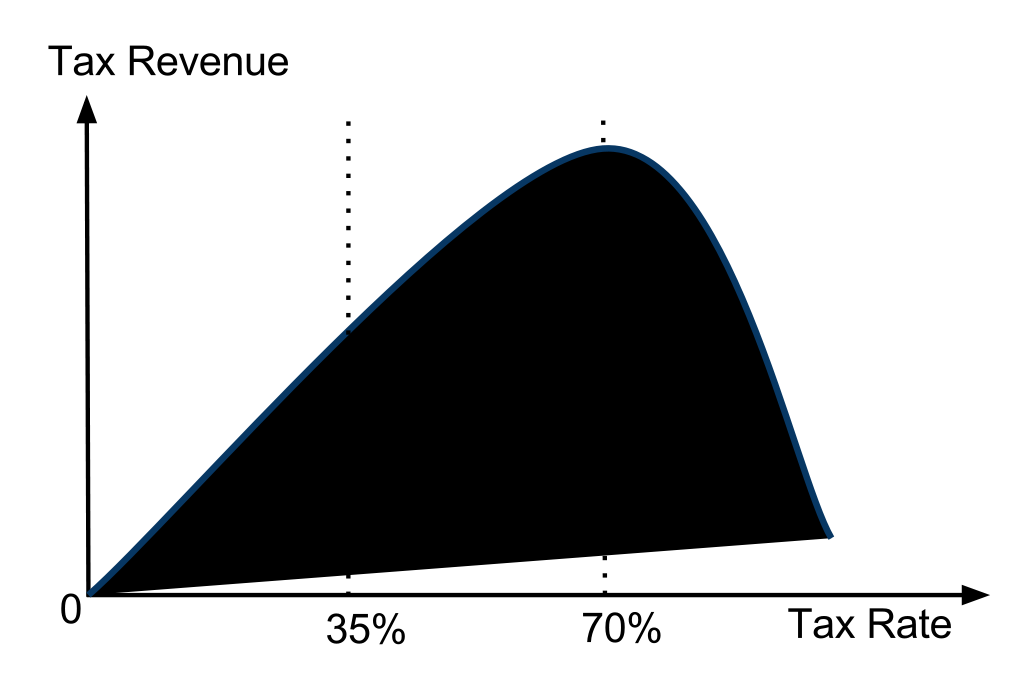

One of the most influential theories on the relationship between tax rates and tax revenues is the Laffer curve, proposed by Arthur Laffer in 1974. The Laffer curve is a graphical representation of the idea that there is an optimal tax rate that maximizes tax revenues, and that beyond this point, increasing tax rates will actually reduce tax revenues, as taxpayers will have less incentive to work, save, invest, or comply with taxes. The Laffer curve is based on the assumption that tax rates affect the taxable income of individuals and firms, and that there is a trade-off between efficiency and equity in taxation.

However, the Laffer curve is not a precise or universal concept, as different types of taxes may have different effects on behavior and revenue. For example, income taxes may have a larger impact on labor supply and savings than consumption taxes, while corporate taxes may affect investment and innovation more than personal taxes. Moreover, the shape and position of the Laffer curve may vary depending on the economic and institutional context, such as the level of development, the degree of inequality, the quality of governance, and the availability of tax loopholes.

Empirical studies have tried to estimate the optimal tax rate or the revenue-maximizing tax rate for different countries and time periods, but the results are often inconclusive or conflicting. Some studies suggest that the optimal tax rate is relatively low, around 30% or less, while others indicate that it is much higher, above 70% or even 80%. The variation in estimates may reflect differences in data sources, methods, assumptions, and definitions of variables.

The relationship between tax rates and tax revenues has important implications for fiscal policy and public finance. On one hand, lowering tax rates may be desirable if they are above the optimal level or if they distort economic decisions and create inefficiencies. On the other hand, raising tax rates may be necessary if they are below the optimal level or if they fail to generate enough revenue to finance public goods and services. In any case, policymakers should also consider other factors besides revenue collection when designing tax systems, such as fairness, simplicity, transparency, and stability.